Mold Insurance Claims: A Renter’s Guide

Mold insurance claims come in handy when renting in sunny or, being honest, humid Sunshine State. Living in a beautiful place like Florida comes with its perks. Still, it also brings challenges, especially when it comes to mold. Mold growth is a common issue for renters, and understanding the ins and outs of mold insurance claims is crucial. This comprehensive guide will explore the complexities of mold insurance claims, offering valuable insights for renters dealing with this pervasive problem. Whether you’re a tenant in any rental property in Florida, this guide is designed to empower you with the knowledge needed to navigate the intricate world of mold insurance claims.

Mold Insurance Claims: Understanding the Basics

Mold insurance claims can be complex, but renters should have a basic understanding. Mold damage is often excluded from standard renters’ insurance policies, leaving tenants vulnerable to significant financial burdens. However, if the mold growth results from a covered peril, such as water damage from a burst pipe, your insurance may provide coverage.

Identifying Covered Perils: Know Your Enemy

Identifying the covered perils is crucial in a successful mold insurance claim. Mold growth is frequently linked to water damage, so incidents like leaks, floods, or plumbing issues may be covered. It is crucial to document the source of water damage and promptly report it to your landlord or property management company. This not only aids in swift remediation but also establishes a paper trail that can support your insurance claim.

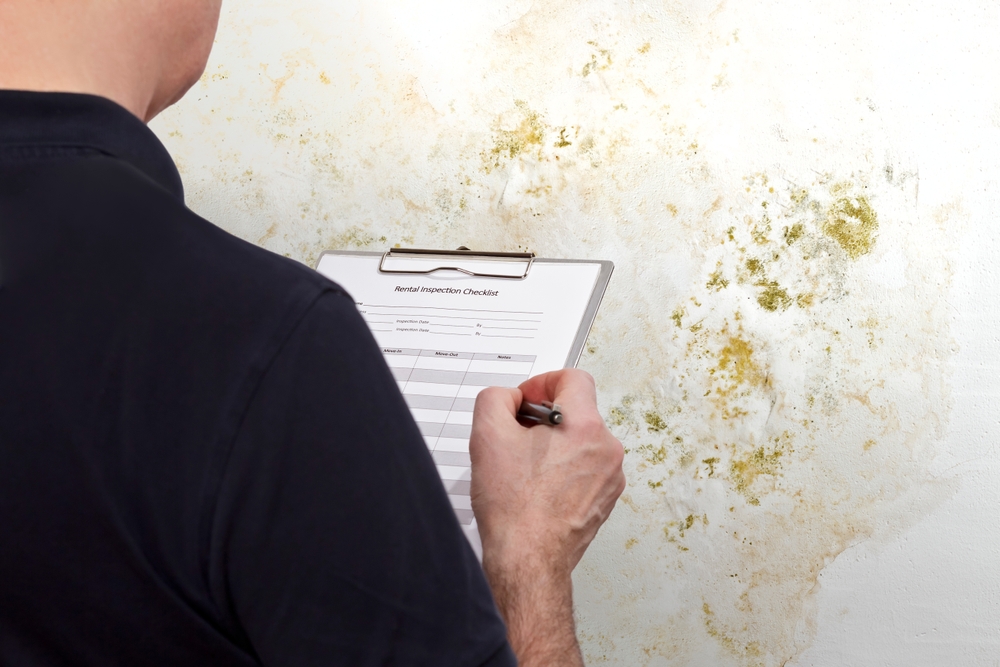

Document, Document, Document: The Importance of Paper Trails

When dealing with mold insurance claims, documentation is your best friend. Take clear, timestamped photos of the mold growth, the affected areas, and any evidence of water damage. Maintain a detailed communication log with your landlord or property management regarding the issue. This documentation serves as tangible proof when submitting your claim and can significantly strengthen your case.

Seeking Professional Assistance: Why ETA Mold is Your Ally

If you’re facing a mold issue in your rental property, turning to professionals like ETA Mold is crucial. Not only can they provide thorough mold inspection and remediation services, but they can also offer valuable documentation and expert opinions to support your insurance claim. Having a reputable mold remediation company on your side increases the likelihood of a successful insurance claim.

The Claims Process: Step-by-Step Walkthrough

Initiating a mold insurance claim involves a systematic process. Here’s a step-by-step walkthrough to guide you through the journey:

- Report the Issue: Immediately notify your landlord or property management about the mold problem. Include detailed information about the source of water damage and any evidence supporting your claim.

- Document Everything: As mentioned earlier, document the mold growth, water damage, and all communication with your landlord or property management.

- Contact Your Insurance Company: Inform your insurance company about the mold issue and initiate the claims process. Provide them with the necessary documentation and be prepared to answer any questions they may have.

- Professional Mold Inspection: Consider hiring a professional mold inspection service like ETA Mold to assess the extent of the mold damage. Their expert opinion and documentation can be instrumental in the claims process.

- Remediation Process: Work with your landlord or property management to address the mold issue promptly. This may involve mold remediation services provided by professionals like ETA Mold.

- Follow-Up: Stay engaged throughout the claims process. Follow up with your insurance company and promptly provide any additional information they request.

ETA Mold: Your Trusted Partner

ETA Mold in Florida stands out as a trusted partner for renters facing mold issues. Their experienced team specializes in mold inspection and remediation, offering comprehensive services that align with the requirements of the insurance claims process. By choosing ETA Mold, you not only prioritize your living environment but also enhance the credibility of your insurance claim.

Conclusion: Empowering Renters in the Face of Mold Challenges

Navigating mold insurance claims can be overwhelming, but renters can overcome these challenges with the proper knowledge and allies like ETA Mold. Remember to document everything, understand the covered perils, and seek professional assistance when needed. Mold insurance claims may be intricate, but with diligence and the right resources, you can ensure a smoother process and regain control over your living space.