Mold Testing Claims in Florida: A Comprehensive Guide

Mold testing claims, when it comes to property damage in Florida, are an important factor in protecting yourself and your home from mold, a formidable adversary. In the Sunshine State’s humid climate, mold thrives, often leading to significant damage and health hazards. For homeowners and property managers, understanding the intricacies of mold testing for insurance claims is crucial. In this comprehensive guide, we at ETA Mold, a leading expert in mold assessment and remediation in Florida, delve into the essentials of navigating mold claims.

Mold Testing Claims: Understanding Mold in Florida

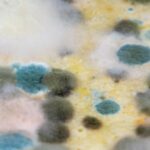

In Florida, the combination of high temperatures and humidity creates an ideal breeding ground for mold. Common types in the area include Cladosporium, Penicillium, Aspergillus, and Stachybotrys chartarum (black mold). These molds can cause various health problems, such as allergic reactions, asthma attacks, and in some cases, more severe health issues.

Recognizing Mold Damage

Mold testing claims have one thing in common: mold. This fungus damage often goes unnoticed until it becomes severe. Signs include a musty smell, visible mold growth, and health symptoms like headaches, coughing, or skin irritation. Recognizing these signs early is crucial for timely remediation and minimizing health risks and property damage.

The Importance of Professional Mold Testing

Why Expert Assessment Matters

Professional mold testing is crucial for mold testing claims and accurately identifying the presence and type of mold. Experts use tools like moisture meters, hygrometers, and infrared cameras to detect mold in hidden places, ensuring a thorough assessment. This is vital for effective remediation strategies and for supporting insurance claims. ETA Mold uses a combination of visual inspection and scientific testing to accurately identify mold infestation levels. This includes air sampling to determine mold spore count and surface sampling to identify mold types. This thorough approach ensures comprehensive detection and assessment of mold issues.

Mold Testing for Insurance Claims

Navigating Insurance Policies

Insurance coverage for mold damage often depends on the policy’s specifics and the cause of mold growth. Typically, insurance covers mold damage if it is a result of a “covered peril,” like a sudden plumbing leak. However, mold due to ongoing issues like high humidity or leaks over time may not be covered.

The Role of Mold Testing in Claims

Mold testing is critical for insurance claims as it provides documented evidence of the presence and extent of mold. This documentation is essential for claim approval as it establishes the link between the mold and a covered incident, detailing the extent of the damage for accurate claim assessment.

The Claim Process: Step by Step

Documenting and Reporting Mold Damage

When mold is discovered, it’s important to document the damage with photos and a detailed description. The next step is to have a professional assessment conducted, which provides a report to submit to the insurance company. This report should detail the extent of the mold, the suspected cause, and the recommended remediation.

Working with Insurance Companies

Communicating with insurance companies involves submitting the mold assessment report and any additional documentation they require. It’s essential to understand the terms of the insurance policy and to follow up regularly to ensure the claim is processed timely.

Preventing Future Mold Issues

Proactive Measures for Mold Prevention

Preventing mold involves controlling indoor humidity, ensuring good ventilation, fixing leaks promptly, and regularly inspecting for early signs of mold. Using dehumidifiers and maintaining HVAC systems are also effective strategies.

Regular Inspections and Maintenance

Regular property inspections can identify potential mold issues early. These inspections should focus on areas prone to moisture, like bathrooms, kitchens, and basements. Preventative maintenance, like sealing leaks and ensuring proper ventilation, is key to preventing mold growth.

Conclusion

Understanding and managing mold in Florida requires a proactive approach, including regular inspections, prompt remediation, and clear communication with insurance companies when claims are necessary. ETA Mold is committed to providing comprehensive mold testing and guidance through the insurance claim process, ensuring property owners can effectively address and prevent mold-related issues.