Mold Insurance Claims for Businesses in Florida: Top Guide

Mold insurance claims are something to think about when living or having a business in the Sunshine State. In the humid and often unpredictable subtropical climate of Florida, mold infestations can pose a significant threat to businesses. Not only can mold cause extensive property damage, but it also presents health risks to employees and customers. Understanding how to navigate mold insurance claims is crucial for Florida businesses to ensure they are adequately protected and compensated. In this easy-to-process but effective guide, we at ETA aim to shed light on the complexities surrounding mold-related insurance claims and handle them effectively.

Mold Insurance Claims: Understanding Coverage Policies in Florida Business

Many business insurance policies in Florida include coverage for mold damage, but the extent of this coverage can vary. It’s important to review your policy details to understand the limitations and exclusions. Typically, policies cover mold damage caused by a “covered peril,” such as water damage from a leaking roof. However, mold resulting from long-term neglect or poor maintenance may not be covered.

Insurance plays a pivotal role in addressing mold-related issues for businesses. Commercial property insurance typically covers mold damage resulting from covered perils, such as water damage from burst pipes or storms. Business owners should review their insurance policies to understand the extent of coverage for mold-related damages.

- Understanding Coverage Limitations

While insurance provides coverage for mold damages, certain limitations and exclusions may apply. Common exclusions include damages resulting from long-term neglect or poor maintenance. It’s essential for businesses to comprehend these limitations to set realistic expectations regarding their insurance coverage.

The Impact of Mold on Florida Businesses

Mold can significantly impact the health of your employees and customers, leading to potential lawsuits or business interruptions. It can also cause structural damage to your property, resulting in costly repairs. Immediate action is necessary to mitigate these risks.

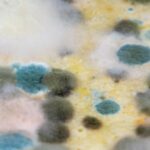

- Recognizing the Signs of Mold Infestation

Early detection is key to mitigating mold damage. Common signs of mold infestation include musty odors, visible mold growth, and respiratory issues among occupants. Businesses should conduct regular inspections and be vigilant for any indicators of mold presence to address the issue promptly.

Why Mold Claims Matter

When facing mold issues, businesses should promptly file an insurance claim. This involves notifying the insurance company, providing documentation of damages, and collaborating with adjusters to assess the extent of the loss. Timely and accurate filing enhances the chances of a smoother claims process.

5 Steps to File a Mold Insurance Claim in Florida

- Immediate Action: As soon as you notice mold, document the damage with photos and videos. This evidence is crucial for your insurance claim.

- Review Your Insurance Policy: Understand what your policy covers regarding mold damage. If you’re unsure, consult with your insurance agent.

- Professional Mold Assessment: Hire a professional mold remediation company like ETA Mold to assess the extent of the damage. A professional assessment can provide credibility to your claim.

- File the Claim Promptly: Contact your insurance provider as soon as possible to start the claims process.

- Keep Detailed Records: Document all communications with your insurance company and keep receipts of any expenses related to mold damage.

Challenges and Pitfalls in Mold-Related Claims

While navigating mold insurance claims, businesses may encounter challenges such as disputes over coverage, delays in claim processing, or disagreements with adjusters. It’s essential to be aware of these potential pitfalls and, if necessary, seek legal counsel to address disputes and ensure a fair resolution.

- Dealing with Insurance Adjusters

Insurance adjusters will investigate your claim to determine the extent of the insurance company’s liability. Be prepared to provide them with all necessary documentation and access to inspect the damage.

- Understanding Denials and Disputes

If your mold insurance claims is denied, you have the right to dispute the decision. You can seek a second opinion from an independent adjuster or consult with an attorney specializing in insurance claims.

Engaging Professionals: Assessors and Remediation Experts

To bolster their insurance claim, businesses should engage professionals like assessors and remediation experts. Assessors evaluate the extent of mold damage, providing a comprehensive report that aids in the claims process. Remediation experts ensure effective mold removal and prevention, addressing the root cause of the issue.

Preventing Future Mold Issues in Your Florida Business

Regular maintenance and humidity control are key to preventing mold growth. Ensure that your business has adequate ventilation and promptly address any water leaks or damage.

Conclusion:

Mold insurance claims in Florida can be complex, but with the right knowledge and preparation, businesses can navigate these challenges effectively. Remember, prompt action and thorough documentation are your best tools for ensuring a successful claim. At ETA Mold, we are committed to helping Florida businesses deal with mold issues swiftly and efficiently.

For more information on mold insurance claims, make sure to contact or address your local insurance company to discuss your business insurance policies. For more mold prevention and remediation, visit our website, ETA Mold, and explore resources from official organizations like the Florida Department of Health Florida Department of Health.